Government in poor value for money shocker!

Submitted by JG on Thu, 06/09/2007 - 13:37Government in poor value for money shocker! This time, however, it is a "master class in bungling"!

Government in poor value for money shocker! This time, however, it is a "master class in bungling"!

Britain's first written constitution should be drafted by a convention whose membership has been partly chosen by random lot, the Liberal Democrats propose today. Half of those involved should be members of the public, with the others drawn from parliament, and the final draft subject to a national referendum.

http://www.guardian.co.uk/guardianpolitics/story/0,,2163001,00.html

The education debate has rumbled on longer than usual it seems this year in the aftermath of the annual GCSE/A level dumbing down standards debate. One of the reasons, I suspect, is that the mass investment from the Labour government is coming home to roost with little to show for itself. An Office for National Statistics (ONS) report today certainly backs this up. It states that despite a decade of reforms when education spending nearly doubled, exam results did little better than keep pace between 1996 and 2006. That is to say while spending on education increased by 83 per cent in ca

Radical plans to create a network of smaller inner city secondary schools were unveiled by the Conservatives yesterday. The party's policy blueprint for reforming public services suggests stealing an idea already used in the US – whereby high schools with 2,000 or more pupils are split into four different schools, each with a separate identity, thus transforming their examination results.

Despite reports last week that the NHS has gloriously balanced the books and managed to hoard £1bn of public money to "reinvest" in the health service, there are reports that Junior Doctors are being short changed by £500 a week due to...

A university student who put her feet on a train seat has been summonsed to appear before a court for "wilfully interfering with the comfort or convenience" of other passengers. Kathleen Jennings, 19, from Oldham, said she was approached by an enforcement officer as she sat on the train. When reprimanded, she took her feet off the seat straight away, but still finds herself facing the possibility of a criminal record.

There was a flurry of triumphant snorts on Friday when some libertarian blogs picked up a post from earlier in the month, which had commented on the recent paper by William Nordhaus on carbon-pricing. The ASI got it from voluntaryXchange, who got it from Newmark's Door, who had spotted the original post at ReasonOnline. The excitement was because Nordhaus, described variously as "perhaps the world's leading expert on the economics of climate change" and "the economic expert on global warming", had done some modelling of the optimal profile of carbon-pricing, and had concluded that, as the ASI put it, "the suggestions of both the Stern Review and Al Gore don't cut it". Rather, Nordhaus estimates that the optimal level in 2010 for the price of carbon is $34 per tonne (tC), equivalent to around 9 cents per gallon of petrol (i.e. bugger all in the grand scheme of things).

Just a couple of points:

1. Apart from the original article (Reason) they conveniently forgot to report that Nordhaus was not advising a static price, but one which should increment in real terms by around 2.5 per cent per year, to $42/tC in 2015, $90/tC in 2050, and $207/tC in 2100. Those later prices would be felt more keenly, if it weren't for the likelihood that they will be dwarfed by higher fossil-fuel prices by then.

2. More importantly, although Nordhaus's paper dresses the analysis up in a great deal of elaborate academic clothing (and very much more substantial clothing than Stern and Gore, it has to be agreed), it all pretty much boils down to the usual culprit - the discount rate. If, like Stern, you believe that it is wrong, on moral grounds, to discount the costs of future disaster, then you choose a very low (almost zero) discount rate and end up with enormous present costs for future risks attributable to global-warming, and therefore a rationale for taking strong, immediate action based on a high present cost of carbon. If, like Nordhaus, you believe that close-to-zero discounting is irrational, you set a modest discount rate which, over the timescales over which the impacts of global-warming might be felt, reduces the present costs of even catastrophic events to quite low values and results in a steady-as-she-goes policy prescription.

The funny thing is that both Stern and Nordhaus can present simple illustrations that demonstrate the irrationality of the opposing perspective. Stern can say, as paraphrased by Nordhaus, that "a positive time discount rate would lead societies to ignore large costs that occur in the distant future." In other words, if one combines economists' willingness to put a value on life with a modest discount rate, one can end up with a low present value for the deaths of even millions of people sufficiently far in the future (and thanks to the wonders of compounding, not that far into the future). It follows that it isn't worth doing much now to avoid large numbers of deaths, even if our actions make those deaths inevitable, provided that those deaths are not too soon.

On the other hand, Nordhaus gives his "wrinkle experiment" illustration of the absurdity of Stern's use of minimal discounting. "Suppose that scientists discover a wrinkle in the climate system that will cause damages equal to 0.1 percent of net consumption starting in 2200 and continuing at that rate forever after", he muses. "How large a one-time investment would be justified today to remove the wrinkle that starts only after two centuries? Using the methodology of the Review, the answer is that we should pay up to 56 percent of one year’s world consumption today to remove the wrinkle. In other words, it is worth a one-time consumption hit of approximately $30,000 billion today to fix a tiny problem that begins in 2200."

So we have two competing approaches, both of which yield absurd results. Should we just choose the version of absurdity that we prefer? Or argue that, in medio veritas, the truth must lie somewhere (but who knows where) between two absurd positions? Or should we stop and consider whether the problem lies with what these two approaches have in common?

What this is telling us is that we have reached the limits of the usefulness of mathematical economics. Though it came to dominate economics over the course of the twentieth century, it was always a dead end. Now we see exactly how sterile and ridiculous is the idea that you can model human action with numbers and formulae. Climate-change theory turns out to be the perfect reductio ad absurdam test of neo-classical, welfare economics. And it fails.

Mark Wadsworth (whose blog is one we recommend in our blogroll) managed to get a long (by their standards) letter published in yesterday's FT, criticizing John Redwood's focus on reducing corporation tax, when in Mark's opinion greater emphasis should be placed on reducing VAT and National Insurance (NI). Well done for getting published, Mark. You are half right.

You are right that some taxes need reducing more urgently than corporation tax, and that NI is one of them. On the other hand, Redwood is nevertheless right that we need to cut corporation tax (if not as a priority above other cuts), and you are wrong about VAT as a priority.

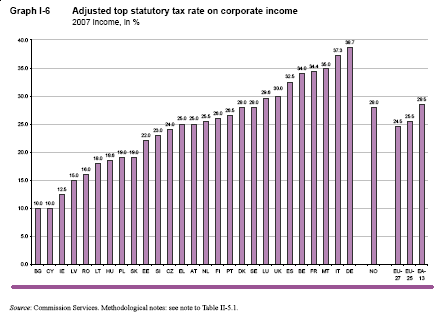

I say this with some confidence, because I happened, the day before, to be browsing the latest version of Taxation trends in the European Union - Data for the EU Member States and Norway, from Eurostat, the EU's statistics office (yes, I am that sad). The figures in there do not support Mark's argument in its entirety.

Corporation tax needs cutting because, although our biggest competitors have higher rates, we are not only in competition with them, but with the 20 other European countries that have lower rates than us. Not to mention the BRICS countries, and other developing nations. Your principal competitors change according to who is competing most aggressively. The best way to lose your competitive position is to focus complacently only on your old competitors.

Corporation tax needs cutting because, although our biggest competitors have higher rates, we are not only in competition with them, but with the 20 other European countries that have lower rates than us. Not to mention the BRICS countries, and other developing nations. Your principal competitors change according to who is competing most aggressively. The best way to lose your competitive position is to focus complacently only on your old competitors.

(Having said, that, one does need to be careful about what one means by "competitiveness", as Samuel Brittan, pointed out in yesterday's FT. But the conditions that influence where businesses choose to invest and to book more or less of their profits does seem a legitimate area for international tax competition.)

It also needs cutting because high rates of corporation tax distort investment decisions, as companies structure deals and decide their levels of borrowing and saving in order to minimize their tax bills rather than because of the fundamentals. And because experience in countries (particularly in Eastern Europe) in recent years suggests that high rates are at an inefficient point on the Laffer Curve, and that cutting rates to below our current level can increase (or at least, not significantly reduce) revenues.

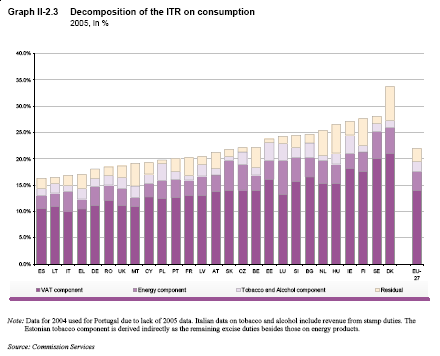

Although the comparisons for consumption taxes indicate that the UK's rates are already pretty competitive, it would be misleading for me to suggest that we are in competition over rates of VAT in the same way that we are in competition on corporate tax. Most of us do not have much option to go to another country to consume our goods. The costs of doing so are likely to be very much greater than the tax benefit. Nevertheless, it does raise doubts as to whether further reductions in VAT should be an urgent priority.

Although the comparisons for consumption taxes indicate that the UK's rates are already pretty competitive, it would be misleading for me to suggest that we are in competition over rates of VAT in the same way that we are in competition on corporate tax. Most of us do not have much option to go to another country to consume our goods. The costs of doing so are likely to be very much greater than the tax benefit. Nevertheless, it does raise doubts as to whether further reductions in VAT should be an urgent priority.

VAT does not have much impact on costs of production, thanks to the offsetting of VAT on purchases against VAT on sales. It is effectively a tax on final consumption. Apart from the case of one-to-one transactions involving personal services (e.g. paying in cash for your gardener or cleaner), it is relatively unavoidable. Nor is it so high (at 17.5% nominal, 11% implicit, i.e. taking into account lower rates and exemptions) that it will be deterring significant levels of economic activity, relative to other taxes whose rates are significantly higher. Consequently, a reduction in VAT is likely to have a near-proportionate impact on tax revenues - there is unlikely to be a significant Laffer-Curve benefit.

Mark argues that "VAT does not just increase the price paid by the consumer; it also reduces the net price received by the producer. Thus low-margin producers are forced out of business and output is reduced quite significantly." Well, yes, it will be a bit of both, though the combined effect will remain 17.5% (or whatever rate of VAT applies to the good). The balance between one and the other will depend on commercial decisions, which will be heavily influenced by price-elasticity of demand. If demand is inelastic, producers should be able to pass on most of the cost to consumers without dramatically affecting volume, and therefore profits. If demand is elastic, producers will have to choose between passing on the costs to consumers and accepting a lower level of demand, or absorbing the cost to maintain volume, but reducing margins/profits. Their balance of fixed vs variable costs will play a significant part in that decision.

The net effect, as Mark says, is that some marginal products are not brought to market, the volumes of some other products are reduced, and the prices of goods that are essential or at least strongly desired, are higher than would otherwise be the case. But this is not different in effect to other taxes. Corporation tax also affects either the level of profits or the price at which the company's goods must be sold in order to deliver the return on investment necessary to persuade people to invest (or retain their investment). At the margins, it will also cause businesses not to be setup or to divert their funds into more profitable activities, which reduces the range of products available and the volume of transactions, and increases the price of goods for which demand is inelastic. And income tax and NI increase the cost of producing goods with a significant labour input, causing fewer of those sorts of goods to be produced and increasing the cost to consumers of essential, high-labour goods. All taxes have this sort of effect - it is a question of striking a balance between their impact on the economy and the need to raise revenue. In that regard, 17.5% (or 11% on average) on consumption could be expected to have a less significant impact than 28% on profits or 40-50+% on employment.

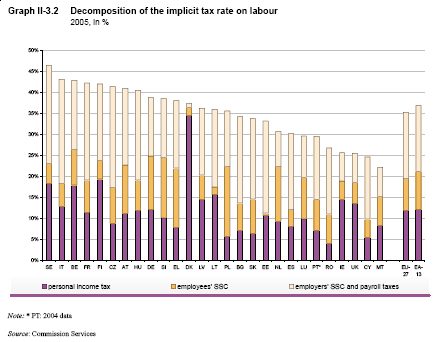

It is that latter figure that seems a particularly strong disincentive to something particularly desirable. NI, of course, is part of the tax on employment, and the most regressive part at that. I am in agreement with Mark on this, and yet the European figures once again do not appear to support us. The only countries in Europe with lower implicit (i.e. weighted average) tax rates on labour, including income tax and employer/employee social security contributions (SSCs, i.e. NI in the UK) are the tiddlers of Greek Cyprus and Malta. It seems that the UK government is taxing labour relatively lightly. Moreover, our SSCs are a relatively low proportion of the whole (less than half the average) compared to most of our neighbours, whereas our income-tax rates are higher than average, which might suggest that NI isn't even the place to start if one were reforming UK taxes on labour.

It is that latter figure that seems a particularly strong disincentive to something particularly desirable. NI, of course, is part of the tax on employment, and the most regressive part at that. I am in agreement with Mark on this, and yet the European figures once again do not appear to support us. The only countries in Europe with lower implicit (i.e. weighted average) tax rates on labour, including income tax and employer/employee social security contributions (SSCs, i.e. NI in the UK) are the tiddlers of Greek Cyprus and Malta. It seems that the UK government is taxing labour relatively lightly. Moreover, our SSCs are a relatively low proportion of the whole (less than half the average) compared to most of our neighbours, whereas our income-tax rates are higher than average, which might suggest that NI isn't even the place to start if one were reforming UK taxes on labour.

And yet, it is still true that our employment taxes are too high. Eurostat knows it too:

"Despite the presence of a number of low taxing countries, taxation on labour is, on average, much higher in the EU than in the main other industrialised economies. The effective tax rate on labour in the United States was estimated at just 23.9 % in 1999, compared with an EU-25 ITR of 36.3 % for that same year. Carey and Rabesona (2002) estimated a 24.9 % average effective tax rate on labour for the United States in 1999, i.e. 12 percentage points less than the estimate for the EU-15; the difference with Korea (13.9 %) was even more than 20 percentage points. Values for Japan (23.0 %), New Zealand (23.0 %), Australia (25.3 %), Canada (30.3 %), and Switzerland (31.1 %) were far below the EU-15 average, too. Martinez-Mongay (2000) found broadly similar differences between the EU and the United States and Japan. Indirectly this is confirmed by OECD data on the tax wedge."

And that's just the industrialised countries. The comparison with the developing nations will be even less favourable.

In this case, like corporation tax and unlike VAT, there is an element of international competition, as labour can move, if not as easily as capital. We see the effect in the inflow of Eastern Europeans to the UK at the moment (they could equally have gone to Sweden rather than Britain or Ireland, but the numbers were proportionately lower to the high-tax country that opened its doors) or the numbers of French already here, and the outflow of Brits to countries like Australia and the USA. The only country with higher taxes (and then not much, and not in terms of the proportion paid by the employee) to which there are major flows of Brits is Spain, and most of those are going there to retire.

The universal impact of taxes - of preventing some goods being produced, of reducing the volumes of other goods, and of pushing up the price of goods for which demand is least elastic - applies to taxes on employment as much as any other. But it manifests itself in specific and particularly harmful ways. The goods that are not being produced or are produced in lower numbers or are being made more expensive (without the producer benefitting) are jobs. The only way that high employment can be balanced with high taxes on employment is if people are prepared to accept a lower level of take-home pay. But as take-home pay has a significant impact on the sustainable level of demand in the economy, even that would not prevent high employment taxes from having a deleterious impact on the economy and people's wellbeing. And in practice in Europe, there is strong resistance to rebalancing levels of pay to take account of the cheaper labour and lower taxes that can be found elsewhere. The result is predictable and borne out by experience - high unemployment and low growth.

We may look smugly at the relative, official levels of unemployment and growth in Germany, France and the UK and believe that we are doing better than them. But while we undoubtedly have been doing better on average than those of our neighbours who have been slowly strangling themselves for the past decade or more, we are not so much better as the official figures might suggest. Our (un)employment figures are massaged by moving an incredible number on to disability benefit, and our employment figures are entirely dependent on the vast number of additional public-sector jobs (for which demand is unaffected by employment taxes because their "customers" - taxpayers - have no option until election-time but to pay the extra) that have been created since 1999. Worse still are our effective, marginal rates of tax (taking account of means-tested withdrawal of benefits), which provide a strong disincentive for those on benefits to seek work, unless they can jump straight into a high-paying job. We may only be mutilating rather than strangling our economy, and hiding our self-inflicted wounds better than our competitors, but it does not diminish the long-term impact, which is that competitors from outside Europe are catching us up or leaving us behind.

The first priority is clear, and I don't think would be in dispute between Mark, John Redwood and myself (though it would appear that Redwood's party, like the others, would dispute this). We must reduce the size and cost of government as much as possible, so that we are able to reduce the burden of taxation in general. But it will not be possible to reduce taxation to a level which has little impact. Priorities have to be chosen with regard to where the burden of the state should fall. As that burden is effectively a disincentive, it is, in significant part, a question of what one is least reluctant to disincentivize: jobs, profits or consumption (to limit ourselves to the three options considered by Mark). Though it is not ideal to discourage any of these, it seems to me that the least harmful of the three to deter is consumption, then profits, with employment being the least desirable thing to penalize. As things stand, the priorities are in exactly the reverse order. Redwood would rebalance it in favour of profits. Mark would rebalance it in favour of employment and consumption. I would rebalance it in favour of employment and, to a lesser extent, profits.

It seems that Mark and I agree on one other thing, though - perhaps more important than the levels of taxation, to complement the emphasis on reducing the level of tax on employment. Nominal rates are all very well and a worthy target for reduction, but what really matters are effective and marginal rates. This brings into play other factors, such as personal allowances and benefits. In comments on Mark's post, Vindico (a fellow individualist whose blog is now added to our blogroll) suggested that a flat tax be combined with a Basic Income (BI) to achieve a more efficient balance of effective and marginal rates of taxation. Mark agreed enthusiastically, and so do I.

I have been trying to promote BI as an efficient, liberal, compassionate alternative to welfare, and not necessarily a left-wing policy as many seem to assume, for some time. All reforms of the tax system, fiddling with the calculations for means-testing benefits, and sounding tough about forcing people back to work, will have little effect on the draconian levels of effective, marginal rates of taxation on low-earners that keep many of them out of work. Only a Basic Income can solve this. It is a sine qua non of genuine tax and benefit reform. If UKIP were to make it part of their programme, as Mark says they are considering, they would gain at least one more supporter.

GdF is an energy company, Suez operates in the energy and environment sectors. They want to merge. The French government is intervening to tell Suez that it must divest itself of its environment division if the merger is to go ahead. Why is that?

Is it on competition grounds? Quite the opposite. The competition threat comes not from the merging of Suez's environment division with GdF's energy activities, but from the merging of the two companies' energy interests. But the French government is not only unconcerned about creating an energy behemoth, it is actively encouraging it as the desirable outcome. They want to create another "national champion".

Is it because there are few synergies between the energy and environment sectors? Suez obviously doesn't think so, and as it is the active partner, protecting the tasty morsel that is GdF from the terrible fate of being swallowed by a foreign competitor such as Italy's Enel, Suez's opinion ought to count. And there are indeed obvious synergies, for instance in the potential for the use of waste as a source of energy, and in the environmental impact of energy-generating and -supplying activities. The French government has not tried to justify its intervention on these grounds.

No. It is because the French government wants to retain in the merged group the share of influence that it currently has over GdF. As Sarkozy said, "I proposed to Suez that it merge its energy activities with Gaz de France... to build a big gas and electricity group with... the state as principal shareholder."

Let's not worry that its influence has proved so effective that it has made GdF a target of acquisition. Nor that the group in which the French government has less influence (Suez) has been doing better than the group in which it has more influence (GdF). This is not about commercial logic and the good of the businesses in question. It is about power and making sure that the French state has the biggest finger in as many big pies as possible. Commercial logic and competition be damned. The inevitable result of political involvement in commercial activities.

I listened this morning to Nick Ross and James Brokenshire (Tory spokesman on Home Affairs) arguing about crime statistics on Radio 4. Brokenshire claims that the statistics show that violent crime is on the increase. Ross accuses him of cherry-picking from the figures, which show an increase in certain figures but a more general decline. Brokenshire says that the figures he is looking at are the important ones, and anyway his constituents tell him what is really going on.

It is the latter point that really counts, though it is unverifiable. If Brokenshire is lying about what his constituents are telling him, he is at risk of being voted out at the next election. MPs' impressions from their communications with constituents may not be a reliable guide to reality, let alone the correct course of action, as they are necessarily subjective, but they are a more reliable guide to people's experiences than any number of government statistics.

The problem with many debates nowadays is that they rely on statistics, without considering the reliability, accuracy and relevance of those statistics. The Government has helpfully provided (at the time and expense of those who fill out their forms and of taxpayers who pay for it to be processed) a range of statistics for almost any circumstance. Surprise, surprise - amongst these, a statistic can always be found to argue, however obliquely, that the Government is succeeding in its objectives. But as Sir Josiah Stamp observed (quoted in Paul Seabright's The Company of Strangers):

"the Government are very keen on amassing statistics. They collect them, add them, raise them to the nth power, take the cube root and prepare wonderful diagrams. But you must never forget that every one of these figures comes in the first instance from the village watchman, who puts down what he damn well pleases."

It is mostly middle-managers rather than village watchmen filling out the forms nowadays, but the result is the same, if not worse, because there is no prospect that the middle manager or his employer may be rewarded or punished according to the accuracy of the information provided. Their optimal strategy is to waste as little time on it as possible, and to tell the Government what it is in their interests for the Government to believe, not necessarily the truth. Not very different to the village watchman, but with even fewer consequences of dereliction of duty.

Nevertheless, we regularly hear people claiming that crime has risen or fallen, rather than that recorded crime has risen or fallen; or that inflation or unemployment is rising or falling, not that the Government's measure of inflation or unemployment is rising or falling; or, as reported in the news today, that children under 16 are drinking twice as much as they did only a few years ago, rather than that children of that age say they are drinking more. The distinction is crucial, because it is just as likely, perhaps more so, that what has changed is the reporting of a phenomenon, not the actual phenomenon itself.

When we see a Third-World election where the incumbent wins 95% of the vote, we know that it is probably a fraud. In the First-World we are more subtle - governments know that absurdly high numbers are not credible, and anyway most bureaucrats are not consciously corrupt enough to deliberately distort the figures. We have a more subtle form of corruption, but also a more pernicious form because of its subtlety. It is the form of corruption that was seen most strongly in the Soviet Union, where government by central-planning and targets was more successful at delivering ever-increasing volumes of ever-improving statistics, than at actually delivering the goods that the statistics were supposed to be measuring.

In this regard, we are living in a neo-Soviet Britain. We are governed and incentivized and judged - in short, we are micro-managed - by targets and statistics. No wonder people's efforts become focused on improving the figures rather than the underlying products. We see it most glaringly in the grade-inflation in our education system, but it is ubiquitous in every aspect of our lives. We no longer believe the figures that the ruling and chattering classes love to cite, because we know that they bear little resemblance to reality. And we are right not to believe them. It is no more credible that the educational attainment of our students has improved every year for quarter of a century than that a despot would be supported enthusiastically by 95% of the population.

When Brokenshire and Ross argue about what the statistics tell us about crime levels, they are engaging in entirely sterile debate. We will form our judgments about levels of crime from our experiences, the experiences of people we know, and from the stories we see in the media. If Brokenshire's constituents really are telling him that they feel less secure (and I don't doubt that they are), he should rest his case on that, and not get sucked into bandying unreliable statistics with people who believe that levels of reported crime are the same thing as levels of crime.

Good news at the NHS – they are set to have a whopping surplus of £1bn for the year. A turnaround from the £500m deficit last year. And how have they achieved this? Not through cutting costs in areas that have nothing to do with front line patient care – in fact completely the opposite. While Brown and the gang can say how financially efficient the NHS is, the fact is the cost savings have been made by cutting jobs, below inflation pay rises and cuts in services. Well done Gordon - giving with hand and t

Continuing the theme of declining standards in education, government statistics from the Department for Children, Schools and Families reveal that for the second year running writing standards amongst seven year olds had fallen. They also showed no improvement in areas such as Maths or Science. Now, what this means it is hard to sure – it does indicated that at least they aren’t lowering the standards to improve the headline figures. The results have shown, however, that one in five seven year olds is not reaching the minimum requi

Changes to out-of-hours NHS care could mean that serious illnesses in children are being missed, an expert says today.

http://www.timesonline.co.uk/tol/life_and_style/health/child_health/article2357795.ece

One of Britain’s leading environmental researchers has been chosen by Gordon Brown as the Government’s new chief scientist, The Times has learnt.

The Institute for Paternalism, Protectionism and Regulation today published a report on Energy Security. It is, in the most part, a rehashing of received wisdom, without understanding or insight, but one phrase in the Executive Summary stood out for being more than just vacuous. It is symbolic of the way that this sort of organization, and their friends on the centre-left and centre-right, view the role of government:

"Clearly there is no one-size-fits-all solution to these challenges and undoubtedly a mix of policy measures will be required."

Sounds innocent enough, but consider if you applied the logic in other fields. What about the field from which the phrase is drawn? There is no one-size-fits-all solution for clothing, so the Government needs a mix of policy measures to ensure that the correct balance of sizes is supplied. There tends to be less demand for the smallest and largest sizes, so to reduce the risk that the market may not provide equal choice to these consumers, we will have a policy to encourage or require production of extra-small and extra-large sizes. The larger sizes use more fabric and therefore cost more to produce, so we will have a policy to subsidize outsize clothing, to avoid people being "discriminated" against for their size. There are a range of collar, bust/chest, waste, hip, inside leg and thigh sizes, so we will have policies to ensure that sufficient quantities of each size is produced. And these different measurements occur in a range of combinations. Shall we have policies to try to calculate the incidence of the various combinations, and mandate that production match these calculations? Or shall we mandate the mean or median combinations, as government is fond of doing in other fields (people's deviation from the mean being a "second-order" issue)? How shall we allocate responsibility for production of different sizes and shapes to the various design houses? Should every range have to comply with all these policies, so that no one is deprived of a choice that someone else has, in accordance with the principles of equity? How will small lines survive when they have to satisfy rules that compel them to service the whole market? How much variety will be on offer? And how will new styles, designs, and innovations occur when designers are bound tightly by rules that determine the sizes and shapes that they must offer?

It's ridiculous, of course, but it is no less ridiculous to apply this approach to the many fields, such as energy, where the Government and bodies like the IPPR believe that it is essential to intervene with a wide range of targeted measures. The truth is exactly the opposite. It is precisely because there is no one-size-fits-all solution that it is important for the Government to intervene as little as possible. We need to allow the market to function without skewing it, so we can discover the optimal balance of options.

The Daily Mash has really hit the nail on the head today. Yesterday I wrote about the incredibly stupid idea of encouraging more people to take up science at GCSE by making the exams easier. Today the Daily Mash reports:

Brain surgery exams are to be made much easier because not enough people are applying to become brain surgeons, the Government has announced.

Picking Losers usually focuses on the British Government's failed attempts to introduce policy to make our lives safer, fairer and better - the consequences almost always being that they create more problems than they solve and blow a whole load of tax payers' cash in the process. Why do governments feel that they have to intervene at every given opportunity in every area of life? While Britain is bad in this area and becoming more so over time with an incredibly busy executive and legislature and an ever expanding public sector with an economy based on high tax, high spend, thing

David Cameron said last night that the level of immigration to Britain was too high and placed unacceptable pressure on public services and housing. The Conservative leader had previously been reluctant to speak on immigration, a subject that he believes Michael Howard mishandled during the last election.

http://www.timesonline.co.uk/tol/news/politics/article2351419.ece

Do you think the Government's crime policy has come a little unstuck? Or perhaps it never worked in the first place. Either way, you'd have thought they would think something was up from this example alone...

“A 43 year old woman in Northern Ireland is serving her 31st prison sentence.”

Tim Worstall picked up yesterday on George Monbiot's rant against "neo-liberalism" and its promoters in the Mont Pèlerin Society and elsewhere. George names a large number of participants in the global conspiracy to promote the view "that we are best served by maximum market freedom and minimum intervention by the state", but

"the most powerful promoter of this programme was the media. Most of it is owned by multimillionaires who use it to project the ideas that support their interests. Those ideas which threaten their interests are either ignored or ridiculed. It is through the newspapers and TV channels that the socially destructive notions of a small group of extremists have come to look like common sense."

Which publication could be more representative of this global capitalist conspiracy in the media than the Financial Times? So it was interesting to see the stories they covered that same day, and the angles they took on those stories:

I'd say George has nothing to worry about. When the media's supposed high representative of free markets is loaded down with this much material critical of markets or supportive of big government, it's those of us who believe in freedom that need to worry, not twats like Monbiot who think they know what's best for us. Which leftward slant amongst even our supposed market advocates is not very different to the intellectual climate after the war, which led Hayek, Friedman and co to judge that they needed to found a society to preserve the idea of freedom and to discuss how to promote it. Plus ça change.

Government

Conservatives